Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published News

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

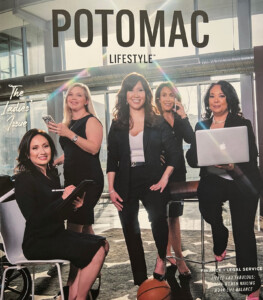

Published Publications

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Other

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Publications

Published Publications

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce Law Source

Published Divorce

Published Divorce Law Source

Published Alimony

Published Alimony

Published Divorce